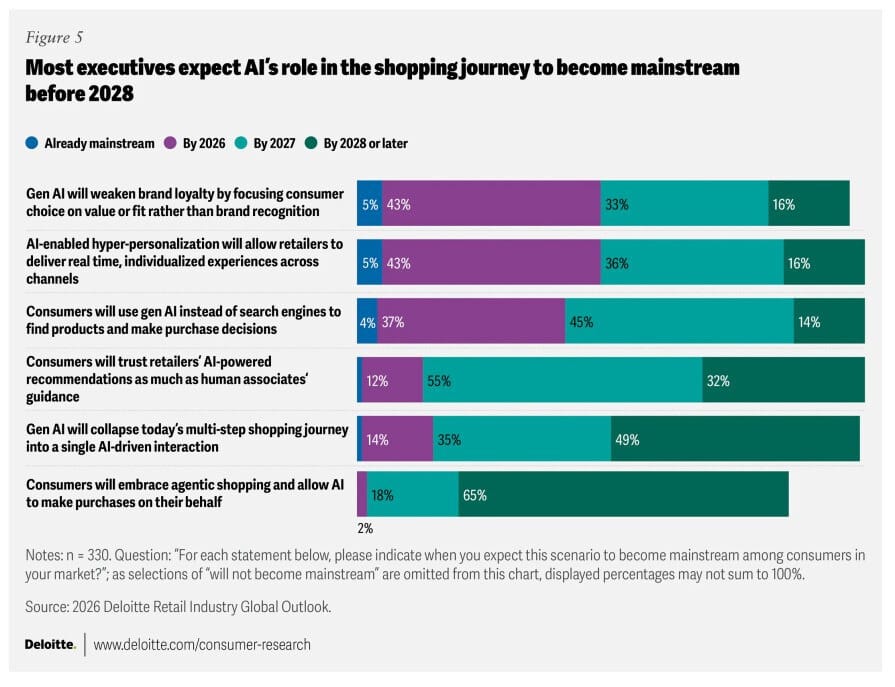

Deloitte’s 2026 Retail Industry Global Outlook contains a particularly shameless lie buried in Figure 5. Eighty-one per cent of retail executives believe generative AI will weaken brand loyalty by 2027, “as the technology focuses on factors like value or fit over brand recognition.”

This is institutional fraud masquerading as market analysis.

The executives aren’t describing what AI does. They’re describing what they’re deliberately doing with AI, then crediting the technology with the destruction they engineered.

Here’s the transaction: For forty years, retail capital extracted margin through brand differentiation. Build emotional attachment. Justify price premium. Harvest the difference. Deloitte calls this “customer centricity.” It is actually rent extraction packaged as relationship.

That model collapsed. Decades of discount retail compressed consumer surplus to zero. Wage stagnation eliminated headroom for brand premium. The margin required to sustain capital costs; the margin that brand investment was supposed to generate; simply vanished.

Executives faced a choice: accept compressed returns or restructure the business model.

They chose restructure. Enter the AI intermediary. ChatGPT. Gemini. The mechanism appears calculated in its simplicity: Consumer asks AI for a winter coat. Specifications and price. The AI searches product databases. Returns results ranked by consumer preference signals: fit, value, availability.

The consumer never visits the retailer’s website. Never sees the brand narrative. Never experiences the lifestyle imagery that justifies premium pricing. Never builds the emotional attachment that generates loyalty. Whether this emerged from market logic or deliberate design hardly matters. The effect is identical.

The retailer observes that loyalty is weakening.

Then they hire Deloitte to explain why this happened to them, rather than admitting they chose it.

The actual mechanism is more sinister. AI intermediation solves retail capital’s existential crisis. When consumers don’t see your brand, they can’t prefer it. They choose private label at lower cost. But private label carries higher margin than branded goods. The brand equity you surrendered gets recaptured as margin on your own products.

Deloitte’s report documents this explicitly: retailers plan to “ensure their product and pricing data are accurate, accessible, and optimised for AI readability.” The phrase isn’t technically false. That’s what makes it fraud. They’re describing search engine optimisation in language designed to sound like data stewardship. Translation: manipulate algorithmic search results to make private-label goods appear first while brand-name products become invisible. This is search engine fraud dressed in technical language.

The consolidation accelerates from there. Without brand differentiation, cost structure becomes the only lever. Labour cuts. Supplier pressure. Inventory reduction. Vertical integration. Smaller retailers collapse. Capital concentrates around firms with proprietary data systems and algorithmic advantage.

The 2026 report captures this entire consolidation and frames it as “financial fortitude” and “cost discipline.” Executives anticipate higher costs (95 per cent) and plan to raise prices (73 per cent), shift to private label (72 per cent).

This is margin protection under crisis conditions. It requires eliminating brand competition. Brand competition is what generated the margin compression that created the crisis.

So executives use AI to justify what they’re actually doing: dissolving brand relationships they can no longer afford to sustain, consolidating capital, and extracting margin through private-label dominance and algorithmic advantage.

Deloitte’s job is to make this consolidation disappear into technological inevitability. To document the destruction as market adaptation. To frame the transition as consumer benefit through price transparency.

The only honest frame: retail executives chose to weaken their own brands because brand investment returned nothing. AI provided the infrastructure for a post-brand retail ecosystem where private label, data monopoly, and operational consolidation replace consumer loyalty.

Deloitte didn’t discover this. Deloitte legitimised it.

The executives knew precisely what they were doing. The survey proves it. They said so directly: AI will weaken brand loyalty.

They ordered a digital murder.